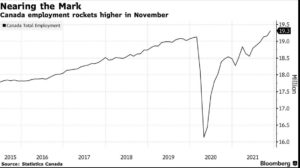

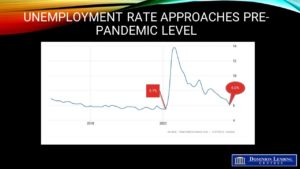

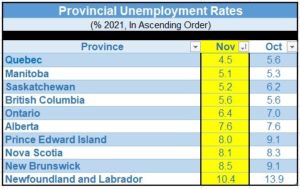

The Bank of Canada decided to keep its target for the overnight rate at 0.25%, in line with forecasts and to maintain its forward guidance, which sees a rise in the overnight rate sometime in the middle quarters of 2022. Until then, policymakers vowed to provide an adequate degree of monetary stimulus to support Canada’s economy and achieve the inflation target of 2%. On the price front, the ongoing supply disruptions continue to support high inflation rates, but gasoline prices, which have been a significant upside risk factor, have recently declined. Still, the BoC expects inflation to remain elevated in the first half of 2022 and ease towards 2% in the second half of the year. Finally, recent economic indicators suggested the economy had considerable momentum in Q4, namely in the labour and housing markets. Still, the omicron variant of the coronavirus and the devastation left by the floods in British Columbia has added to downside risks.

The Bank of Canada decided to keep its target for the overnight rate at 0.25%, in line with forecasts and to maintain its forward guidance, which sees a rise in the overnight rate sometime in the middle quarters of 2022. Until then, policymakers vowed to provide an adequate degree of monetary stimulus to support Canada’s economy and achieve the inflation target of 2%. On the price front, the ongoing supply disruptions continue to support high inflation rates, but gasoline prices, which have been a significant upside risk factor, have recently declined. Still, the BoC expects inflation to remain elevated in the first half of 2022 and ease towards 2% in the second half of the year. Finally, recent economic indicators suggested the economy had considerable momentum in Q4, namely in the labour and housing markets. Still, the omicron variant of the coronavirus and the devastation left by the floods in British Columbia has added to downside risks.

The Bank’s press release went on to say, “The Governing Council judges that in view of ongoing excess capacity, the economy continues to require considerable monetary policy support. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved. In the Bank’s October projection, this happens sometime in the middle quarters of 2022. We will provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation target.”

In October, the Bank ended its bond-buying program and is now in its reinvestment stage. It maintains its Government of Canada bonds holdings by replacing securities as they mature.

Bottom Line

Traders continue to bet that the Bank of Canada will hike interest rates by 25 basis points five times next year. This would take the overnight rate from 0.25% to 1.5%. I think this might be overly hawkish, expecting a more cautious stance of three rate hikes next year to a year-end level of 1.0%. This expectation has already had an impact on economic activity. According to local real estate boards reporting in the past week, November home sales were boosted by buyers hoping to lock in mortgage rates before they rise further next year.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres