|

|

|

|

|

General Mark Goode 24 Jun

|

|

|

|

|

General Mark Goode 18 May

|

|

|

General Mark Goode 9 May

Job vacancies abound in many sectors, yet employers have trouble finding workers to fill those jobs and retaining workers with so many options available. As the jobless rate falls to new record lows, net new employment has slowed. This is not dissimilar to the housing market, where supply is insufficient to meet demand. Home sales are slowing in response to very low inventories, which are now compounded by rising mortgage rates.

Statistics Canada released the April Labour Force Survey this morning, reporting a slowdown in job gains to 15,300, a mere fraction of the 72,500 jump last month and the whopping 337,000 surge in February. The April figure was way below the 40,000 rise anticipated by economists.

After reaching a record low of 5.3% in March, the unemployment rate edged down 0.1 percentage points to a series-low of 5.2% last month, compared to the 5.7% level posted before the pandemic. There is considerable excess demand for workers as the economy failed to produce any new growth in labour supply. In April, hours worked declined 1.9%, reflecting a jump in Covid-related absences and disability.

Increases in employment in professional, scientific and technical services and public administration were offset by construction and retail trade declines. These two sectors are reporting significant labour shortages. The federal government hopes to double the housing supply over the next decade, but to do so, homebuilders need many more construction workers.

More people worked in the Atlantic region and Alberta, while employment fell in Quebec. At the national level, employment gains among core-aged women aged 25 to 54 were offset by a decrease among core-age men.

Average hourly wages were up 3.3% (+$0.99 to $31.06) year over year, similar to the growth observed in March (+$1.03; +3.4%). Since consumer prices have risen 6.7% year-over-year, wages are not keeping up with inflation.

Many signs have pointed to an increasingly tight labour market in recent months. In addition to increases in full-time work, one aspect of this tightening has been a decrease in part-time workers reporting that they would prefer full-time employment. The involuntary part-time employment rate fell to 15.7% in April 2022, the lowest level on record. The involuntary part-time rate had been elevated over the first 18 months of the pandemic and peaked at 26.5% in August 2020, as many workers faced challenges securing full-time employment.

There are signs that wage inflation could accelerate in response to continued high job vacancy rates and tightening labour supply.

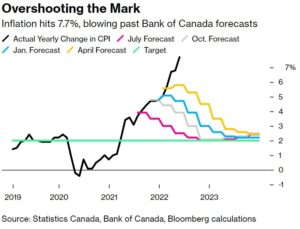

Mounting inflation pressure point to another 50 basis point hike in the overnight rate when the Bank of Canada meets again on June 1. Governor Mackem has stated that a full half-point increase will be in play. That will take the policy rate up to 1.5%, compared to 1.75% immediately before the pandemic. The war in Ukraine has exacerbated supply disruptions and markedly increased key commodity prices. Canada’s economy remains strong–the strongest in the G-7–owing to the relatively large commodity sector. Markets expect the overnight rate to hit close to 3% by yearend. However, the Bank will adjust its plans based on incoming data. Preliminary evidence suggests that housing activity weakened in April due to rising mortgage rates and insufficient supply.

General Mark Goode 19 Apr

Canadian March Home Sales Posted Their Biggest Decline Since June

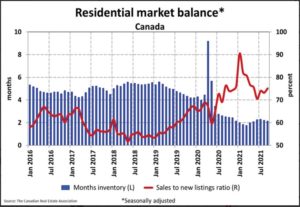

Statistics released today by the Canadian Real Estate Association (CREA) show that rising interest rates were already dampening housing activity well before the Bank of Canada’s jumbo spike in the key policy rate in mid-April. National home sales fell back by 5.4% on a month-over-month basis in March. The decline puts activity back in line with where it had been since last fall (see chart below).

New Listings

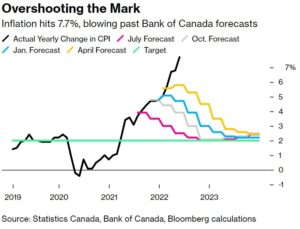

The number of newly listed homes fell back by 5.5% on a month-over-month basis in March, following a jump in February. The monthly decline was led by Greater Vancouver, the Fraser Valley, Calgary and the GTA.

With sales and new listings falling in equal measure in March, the sales-to-new listings ratio stayed at 75.3% compared to 75.2% in February. The long-term average for the national sales-to-new listings ratio is 55.1%.

About two-thirds of local markets were seller’s markets based on the sales-to-new listings ratio is more than one standard deviation above its long-term mean in March 2022. The other third of local markets were in balanced market territory.

There were 1.8 months of inventory on a national basis at the end of March 2022 — up from a record-low of just 1.6 months in the previous three months. The long-term average for this measure is more than five months.

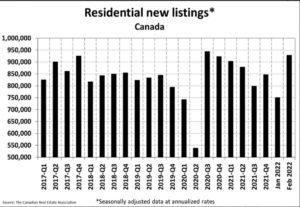

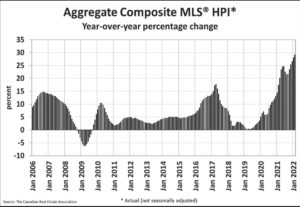

The Aggregate Composite MLS® HPI was up 1% on a month-over-month basis in March 2022 – a marked slowdown from the record 3.5% increase in February.

The non-seasonally adjusted Aggregate Composite MLS® HPI was up by 27.1% on a year-over-year basis in March. The actual (not seasonally adjusted) national average home price was $796,000 in March 2022, up 11.2% from last year’s same month.

Bottom Line

The March housing report is ancient history, as sharp increases in market-driven interest rates have changed the fundamentals. This report also precedes the 50 basis point hike in the overnight policy rate by the Bank of Canada. Anecdotal evidence thus far in April suggests that new listings have risen, and multiple bidding has nearly disappeared.

The rise in current fixed mortgage rates means that homebuyers must qualify for uninsured mortgages at the offered mortgage rate plus 200 bps–above the 5.25% qualifying rate in place since June 2021. This, no doubt will squeeze some buyers out of higher-priced markets.

The federal budget introduced some initiatives to help first-time homebuyers and encourage housing construction–but these measures are hitting roadblocks. Labour shortages are plaguing the construction industry, and the feds do not control zoning and planning restrictions but at the local government level. The ban on foreign resident purchases will likely have only a small impact, so the fundamental issue of a housing shortage remains the biggest impediment to more affordable housing in Canada.

Please Note: The source of this article is from SherryCooper.com/category/articles/

General Mark Goode 8 Apr

|

|

|

|

|

|

|

General Mark Goode 23 Mar

|

| Statistics released today by the Canadian Real Estate Association (CREA) show that national home sales were up in February 2022 as buyers jumped on the first spring listings. The number of newly listed properties surged a welcome 23.7% from extremely depressed levels, hopefully portending a much-needed increase in supply that will continue for the spring selling season. National home sales rose 4.6% month-over-month in February as prices rose 3.5%, taking the y/y price gain to a record 29.2%.

In February, sales were up in about 60% of local markets, led by some big jumps in Calgary and Edmonton. The GTA also outperformed the national averages. The actual (not seasonally adjusted) number of transactions in February 2022 came in 8.2% below the monthly record set in 2021. That said, as was the case in January and throughout the second half of 2021, it was still the second-highest level on record for that month. |

| New Listings

The pullback in new listings in January was reversed in February, rebounding by 23.7% m/m. The monthly gain was led by the GTA, Calgary and the Fraser Valley. With sales up by quite a bit less than new listings in February, the sales-to-new listings ratio fell back to 75.3% after having shot up briefly to 89% in January. The February reading puts the measure roughly back in line with where it has been since the summer of 2020. The long-term average for the national sales-to-new listings ratio is 55.1%. About two-thirds of local markets were seller’s markets based on the sales-to-new listings ratio is more than one standard deviation above its long-term mean in February 2022. The other third of local markets were in balanced market territory. There were just 1.6 months of inventory on a national basis at the end of February 2022 — tied with January 2022 and December 2021 for the lowest level ever recorded. The long-term average for this measure is a little over five months. |

| Home Prices

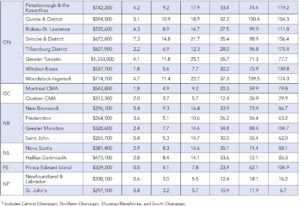

There were just 1.6 months of inventory on a national basis at the end of February 2022 — tied with January 2022 and December 2021 for the lowest level ever recorded. The long-term average for this measure is a little over 5 months. Compared to the national year-over-year increase, gains remain about on par in British Columbia, lower in the Prairies and Newfoundland & Labrador, a little lower in Quebec and Prince Edward Island, and a little higher in Ontario, New Brunswick and Nova Scotia. The regional differences under the surface of those provincial numbers can be seen in the table below. |

| Bottom Line

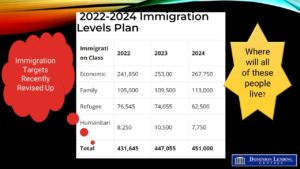

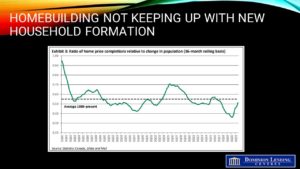

Canada has the most significant housing shortage in the G7. This began in late 2015 when the federal government decided it would target the entry of much larger numbers of economic immigrants. Canada is “underpopulated” and celebrates a growing population, unlike many other countries. There are many job vacancies to be filled, and more people means more economic growth and prosperity for Canada. In mid-February, the federal government revised up its targets for immigration this year and next (see chart below), raising the spectre of even more significant housing shortages going forward. While CMHC announced an 8% rise in February housing starts this morning, home completions are not keeping up with the increase in household formation. The only solution is a sharp increase in new home construction for sale and rent. This requires local zoning regulations to increase housing density and measures to speed up the approval processes. This month, the Bank of Canada began their rate-hiking cycle with much more to come. We believe they will raise the overnight rate again on April 13, with the likelihood of five more rate hikes this year. That would take the overnight rate up to 2.0% by yearend. The Ukraine War has added to future uncertainty, but it has also boosted inflation pressures and increased the risk of a marked economic slowdown. All in, home price pressures are likely to dissipate for the remainder of this year and well into next year. |

Article from: https://dominionlending.ca/economic-insights/canadian-home-sales-rose-in-february-as-new-listings-increased-sharply

General Mark Goode 9 Dec

The Bank of Canada decided to keep its target for the overnight rate at 0.25%, in line with forecasts and to maintain its forward guidance, which sees a rise in the overnight rate sometime in the middle quarters of 2022. Until then, policymakers vowed to provide an adequate degree of monetary stimulus to support Canada’s economy and achieve the inflation target of 2%. On the price front, the ongoing supply disruptions continue to support high inflation rates, but gasoline prices, which have been a significant upside risk factor, have recently declined. Still, the BoC expects inflation to remain elevated in the first half of 2022 and ease towards 2% in the second half of the year. Finally, recent economic indicators suggested the economy had considerable momentum in Q4, namely in the labour and housing markets. Still, the omicron variant of the coronavirus and the devastation left by the floods in British Columbia has added to downside risks.

The Bank of Canada decided to keep its target for the overnight rate at 0.25%, in line with forecasts and to maintain its forward guidance, which sees a rise in the overnight rate sometime in the middle quarters of 2022. Until then, policymakers vowed to provide an adequate degree of monetary stimulus to support Canada’s economy and achieve the inflation target of 2%. On the price front, the ongoing supply disruptions continue to support high inflation rates, but gasoline prices, which have been a significant upside risk factor, have recently declined. Still, the BoC expects inflation to remain elevated in the first half of 2022 and ease towards 2% in the second half of the year. Finally, recent economic indicators suggested the economy had considerable momentum in Q4, namely in the labour and housing markets. Still, the omicron variant of the coronavirus and the devastation left by the floods in British Columbia has added to downside risks.

The Bank’s press release went on to say, “The Governing Council judges that in view of ongoing excess capacity, the economy continues to require considerable monetary policy support. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved. In the Bank’s October projection, this happens sometime in the middle quarters of 2022. We will provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation target.”

In October, the Bank ended its bond-buying program and is now in its reinvestment stage. It maintains its Government of Canada bonds holdings by replacing securities as they mature.

Bottom Line

Traders continue to bet that the Bank of Canada will hike interest rates by 25 basis points five times next year. This would take the overnight rate from 0.25% to 1.5%. I think this might be overly hawkish, expecting a more cautious stance of three rate hikes next year to a year-end level of 1.0%. This expectation has already had an impact on economic activity. According to local real estate boards reporting in the past week, November home sales were boosted by buyers hoping to lock in mortgage rates before they rise further next year.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

General Mark Goode 9 Dec

|

|

|

|

|

|

|

General Mark Goode 28 Oct

|

|||||||||||||||||||||||||||

|

|

General Mark Goode 15 Oct

|

|

|

|

|

|

|

|

|

|